#ACH TRANSACTION DEPOSIT FREE#

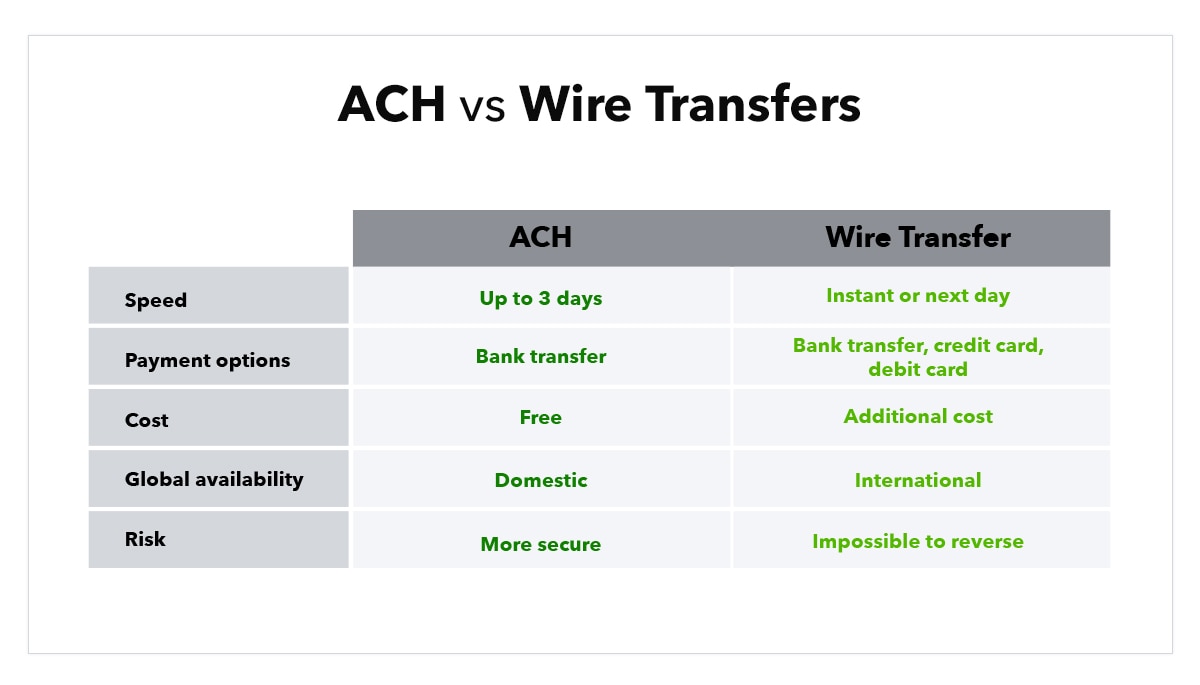

Generally, most ACH transfers, like direct deposit and automated bill payments, are free with your bank account. money transfers is the fees associated with each. Transfer costsĪnother difference between ACH vs. When you need an instant transfer, a money transfer may be a better bet, like when you need to transfer money to a mortgage company for a down payment or make rent payments quickly.ĪCH transfers can be used when the money doesn’t need to be sent instantly, such as when a company processes payroll, you’re using Venmo to pay a friend back for dinner, or you have automatic bill pay set up for utilities or rent. Instead, funds travel through a network that can get the money to the recipient almost instantly. Money transfers can be faster because they aren’t processed through a clearing house. Transfer speedĬompared to other methods of transferring money, such as cashier’s checks or cash payments, both ACH payments and money transfers are relatively fast. Here are some factors to consider when deciding between an ACH transfer and a money transfer. The main differences between an ACH transfer and a money transfer come down to transfer speed, costs, security, regulations, and limits. Money transfers can be used when sending money overseas or when sending large amounts of money, such as to facilitate the purchase of a car or house. Most businesses with direct deposit use ACH transfers for their payroll system. money transfers?Īlthough both are used to send and receive money, there are a few notable differences between ACH vs. If your loved one in New York needs quick cash to help with an emergency, certain money transfer options can get them the money they need almost instantly since there isn’t a clearing house in the middle of this transaction.

This allows you to send funds conveniently without having to move physical money.

Automatic bill pay: Your funds are transferred to the bank account of the organization you’re paying.Direct deposit: Instead of receiving a physical paycheck, it is deposited directly to your bank account.There are many examples of ACH transfers.

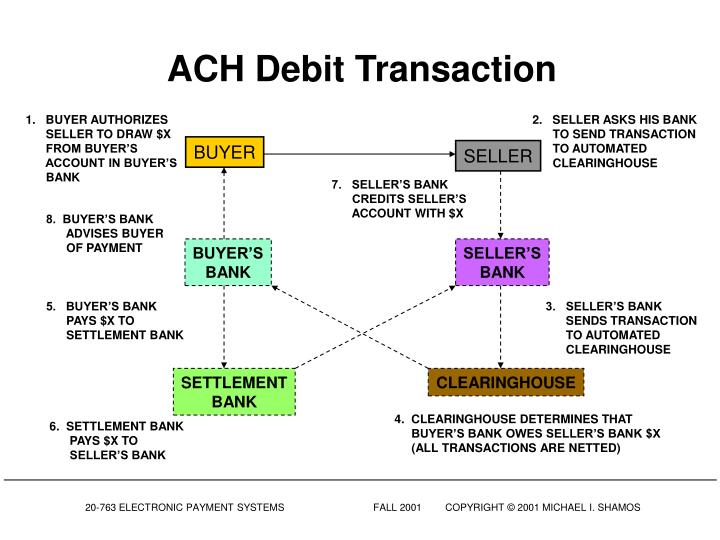

Additionally, banks only process ACH transfers a few times a day, which means ACH transfers can take up to three business days. Since ACH transfers involve an intermediary, it can take extra time to process. The funds then move from the automated clearing house to the recipient’s account. These automated clearing houses act as intermediaries in the transaction and facilitate the transfers. Your bank then compiles all of its ACH transfers a few times a day and sends them to an automated clearing house. Here is how an ACH transfer works: money is deducted from your account and sent to your bank. ACH transfers are electronic transfers between bank accounts that move funds from an account to a clearing house or another account. While you might not realize it, chances are that you’ve used an ACH transfer in the past or currently have a few right now. money transfers and clarify the benefits and considerations for both options so you can get your money where it needs to go fast. Whether you’re a business owner issuing payroll for your employees, sending money for a down payment on your first home, or purchasing goods or services, automated clearing house (ACH) transfers and money transfers are a great way to send money internationally or domestically.īoth methods offer simple options to quickly send and receive money from one bank account to another, but how do you know which one is best for your needs? You’ll want to consider where the money is being sent, how quickly it’s needed, fees associated with the transfer, and more.

0 kommentar(er)

0 kommentar(er)